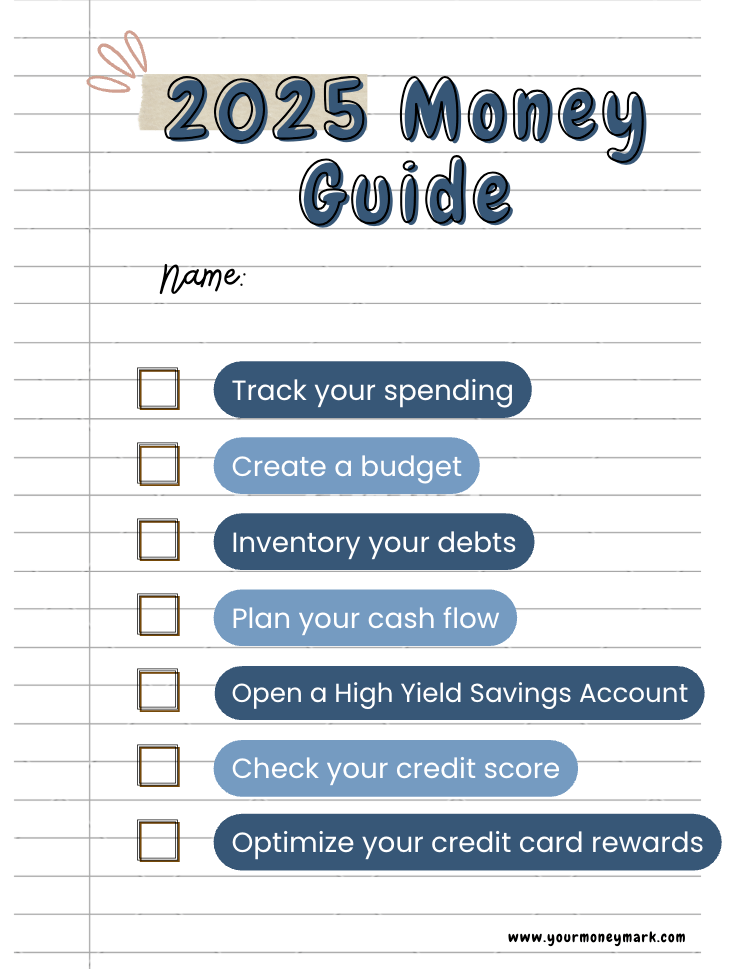

2025 Money Guide

Let’s be honest—setting financial goals can feel overwhelming.

Especially when life is busy, prices are changing, and everything from groceries to gas seems to cost a little more than last year. But building better habits doesn’t have to be hard. Whether you’re working with me 1:1 or just stumbled onto this blog, my goal is to make money management feel doable.

Since 2020, I’ve coached dozens of people toward greater clarity, confidence, and control over their finances. And the same core habits show up again and again. That’s why I created this list of the 8 most impactful actions you can take to improve your money in 2025—with practical benefits tied to each.

Let’s dive in:

💸 1. Track Your Spending

Why it matters: Awareness = control.

Tracking your spending is the foundation for everything else. You don’t need a fancy system—an app, a spreadsheet, or even pen and paper will work. The goal isn’t to restrict—it’s to observe. Once you know where your money is going, you can start directing it where you want it to go.

Bonus Benefit: People who consistently track their spending often report less anxiety about money, even if nothing else changes—because they’re not in the dark.

🧾 2. Create a Budget

Why it matters: Budgets give your money purpose.

Once you know where your money has been going, it’s time to guide where it should go. A good budget is flexible, realistic, and built around your actual lifestyle—not some idealized version of it.

Bonus Benefit: Budgeting helps reduce impulse spending and decision fatigue. You’ll spend less time second-guessing purchases and more time enjoying what you did choose to spend on.

🧮 3. Take Inventory of Your Debts

Why it matters: You can’t tackle what you can’t see.

List everything—credit cards, student loans, car loans, personal loans. Then decide how to attack it. Whether you prefer the Avalanche Method (highest interest rate first) or the Snowball Method (smallest balance first), just start.

Bonus Benefit: Paying off debt improves cash flow and increases your credit score—opening the door to better rates and financial flexibility.

📊 4. Plan Your Cash Flow

Why it matters: Progress doesn’t happen by accident.

Once you free up money from debt payments or reduce your spending, decide where that money will go next. Choose a few clear short-, medium-, and long-term goals (like a vacation fund, home down payment, or retirement boost).

Bonus Benefit: Creating a simple cash flow plan gives you permission to enjoy your money guilt-free—because your essentials and goals are already covered.

🏦 5. Open a High-Yield Savings Account (HYSA)

Why it matters: Put your savings to work.

Traditional savings accounts still offer interest rates close to zero. HYSAs, on the other hand, offer ~4% right now. That means your emergency fund isn’t just sitting there—it’s growing quietly in the background.

Bonus Benefit: Many HYSAs let you create labeled “buckets” for different goals (travel, vet bills, gifts), helping you stay organized and motivated.

🧠 6. Check Your Credit Score

Why it matters: Credit impacts big life decisions.

Whether you’re renting, buying a car, or applying for a mortgage—your credit score matters. Check your score for free through your bank or credit card, and review your official credit reports annually.

Bonus Benefit: Improving your score could mean saving thousands over the life of a loan—not to mention less stress when it’s time to make a major purchase.

💳 7. Optimize Your Credit Card Rewards

Why it matters: Make your spending work for you.

Used responsibly, credit cards can earn you significant rewards—cash back, travel points, or perks like extended warranties and purchase protection. Pair 2–3 cards strategically and you can earn 3–5% back on all of your regular purchases.

Bonus Benefit: With the right setup, you could pay for your next vacation (or holiday shopping spree) using rewards you earned without changing your habits.

📁 8. Consolidate Your Retirement Accounts

Why it matters: Simplicity = fewer fees, better control.

If you’ve changed jobs over the years, chances are you’ve got old 401(k)s floating around. Consolidating them into one IRA can lower fees, simplify tracking, and give you more investment options.

Bonus Benefit: Fewer logins. Fewer statements. Fewer surprises. And a clearer path to retirement.

🎉 Celebrate Your Wins

Big or small—progress deserves a pause and a high five.

Paid off a credit card? Increased your savings rate? Made your first budget that actually stuck? Celebrate it. Just be smart about how you do it. 🙃

📥 Download the 2025 Money Guide

Want a printable version of all this with checklists and goal-setting prompts?

Grab your free copy of The 2025 Money Guide here:

💬 Interested in Financial Coaching?

Let’s make this your year.

I offer 1:1 coaching focused on real-life strategies—like tracking spending, simplifying your finances, and building a sustainable money mindset. No judgment. Just progress.