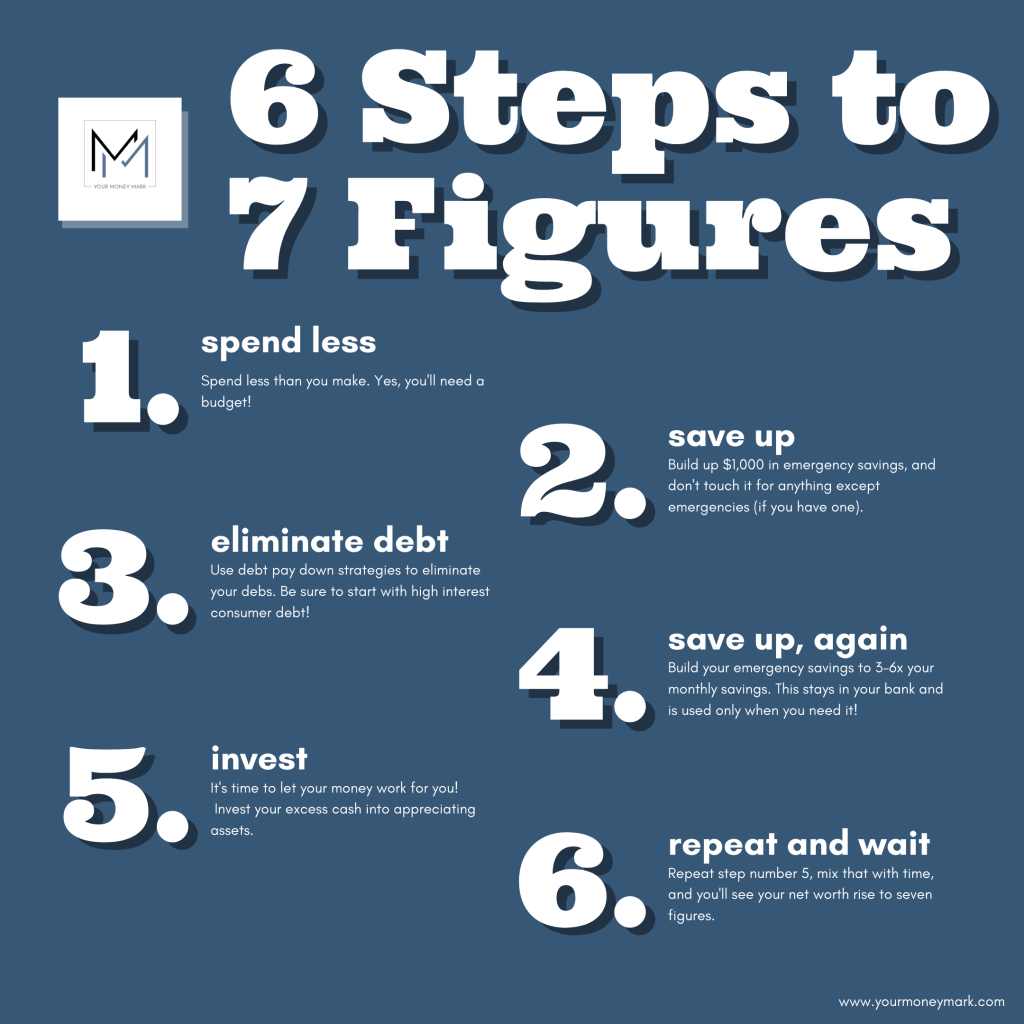

The 6 Steps to 7 Figures

A few days ago, I sat down in the shade in my backyard with a Bud Light seltzer to type up my most recent Instagram post (IG: YourMoneyMark follow for more money tips!). I recalled a stat that I had heard that more than 90% of Americans are first generation rich and I really thought that could inspire a few people to hear they they can become millionaires themselves. So I went to my favorite post design website, Canva, and found an image that would fit well with the message I was trying to say, and it ended up something like this.

Now for the caption, I mentioned “A massive majority of millionaires in America are self made, and not because they started a revolutionary company or an innovative mobile app.” A statement conceptually taken from ‘The Millionaire Next Door‘ (highly recommend especially if you are a statistical person like I am). Because all you need is to follow a few simple steps in order to achieve one of life’s most prestigious statuses.

Step 1: spend less

The first step to seven figures is to get your spending under control. It doesn’t matter if you make $30,000 or $130,000 – If you spend less than you make, you are setting yourself up for success!

Work to create a budget. Understand how much comes in from your job(s) and any other forms of income. Understand how much you spend on everything: housing, transportation, food, entertainment, subscriptions, impulse purchases, EVERYTHING. Hint: use a budgeting app like Mint or create one with my free financial workbook.

A typical budget should reflect the 50/30/20 rule. Simply put, 50% of you after tax income goes towards needs, 30% towards wants, and the remaining 20% towards saving or paying off debt (#2 and #3 in the 6 steps to 7 figures).

So if you bring home 2 paychecks per month totaling $3,000, your breakdown might look something like this:

Rent: $700

Groceries: $250

Utilities: $150

Car/Gas/Insurance: $300

Cell Phone: $100

Needs Total: $1500 or 50%

Bars/Restaurants: $200

Sports/Entertainment: $200

Subscriptions: $50

Gym Membership: $50

Travel: $200

Misc. Spending: $200

Wants Total: $900 or 30$

Savings/Debt Paydown Total: $600 or 20%

Personally, I go a little overboard on my savings plan and I have worked towards something more like 30% needs, 20% wants, and 50% savings. I just view it as a little challenge that I can measure every year. Nerdy fact, every year on January 1 I run through my excel sheet and calculate out my EXACT savings rate so I can put a plan together to beat it the next year.

Step 2: save up

Once you are to a point of having some extra money in that budget, you need to create a $1,000 emergency fund. Now I am NOT telling you to blow off bills or student loans to save up in a bank account, rather while having those items built into your budget, begin saving up in this account. Whether you can contribute $20 or $200 a month to this fund, stick to it and DO NOT TOUCH IT except for emergencies.

Not “I need to go out to dinner emergencies”.

Not “I need to go on this trip I can’t actually afford right now emergencies”.

Real emergencies. Like my car just broke down and it is un-drivable to work type of emergencies.

This step will likely be slow moving, and you’ll have to grind in order to stick to your budget, but it is worth it in the long run. The feeling of not living paycheck to paycheck is incredible.

Step 3: eliminate debt

This part starts to get a little situational. Depending on what type of debt and how much you have left can change the narrative, but in most cases, this is the absolute right next step.

Interest rates on debt are one of the biggest detractors from building wealth. A chunk of every payment you make goes to your lender as a fee for letting you borrow the money. Great for them, terrible for you. Especially on consumer debt which typically presents itself in the form of credit cards.

Credit card debt is more than likely the highest interest rate debt that you have. It can range anywhere from 15% up into the high 20’s, sometimes higher for some individuals. This means that every year, you are paying the credit card 25% if the balance on that card. If you have a $1,000 balance for an entire year, you paid the credit card company $250 just for using their money. Lets break that down.

I am a fan of seltzers, as you could tell from my intro paragraph. White Claw is about $16 per case of 12 (at the time of writing this post). That means that you are losing out 180 cans of seltzer just from putting 1k on a credit card. That’s the kind of thing we cant let go to waste!

Next up is student loan debt. We all know the feeling – making the minimum payment for 3 years after college and decide to check in. WHAT?! HOW IS THE BALANCE HIGHER THAN 3 YEARS AGO?!

Pay. It. Down.

There are a few different strategies that you can follow in order to pay off these kinds of debt: the avalanche method and the snowball method.

Avalanche

The avalanche method is based on the idea of paying down your highest interest loans first. You put all extra money towards the highest interest rate loan while continuing to pay the minimum on all other loans. For Example

1. Credit Card 1: $5,000 balance, 25.4% interest rate

2. Credit Card 2: $2,000 balance, 18.6% interest rate

3. Student Loan 1: $16,000 balance, 6.8% interest rate

4. Student Loan 2: $1,200 balance, 5.4% interest rate

Snowball

The snowball method requires you to rank all of your debt by the balances, smallest to largest. You put all of your extra money towards the smallest debt. Once that one is paid off, you take all of the money that you were spending on the debt paid off, and put it towards the next smallest balance. Helping you gain momentum as you go! For example:

1. Student Loan 2: $1,200 balance, 5.4% interest rate

2. Credit Card 2: $2,000 balance, 18.6% interest rate

3. Credit Card 1: $5,000 balance, 25.4% interest rate

4. Student Loan 1: $16,000 balance, 6.8% interest rate

The downfall of snowball can be those pesky high interest rate, high balance loans that would be eating up your money, so keep an eye on that!

Step 4: save up, again

Now that you have paid off your debt, its time to really take your savings into high gear. But first, celebrate. Pop a bottle of champagne, go out for a drink, take a weekend trip. You deserve it.

With all of that money you are no loger paying towards debt, save up to 3-6x your monthly spending. This is your rainy day fund and is crucial before you can get to Step 5. The purpose of this fund is to support you if you happen to lose your job or have a scenario where you lose income for a significant portion of time (thanks covid…).

Since you have been tracking your budget since step 1, you should be able to very easily calculate how much you need to cover yourself. Taking our budget example above, you spend $2,400 per month on wants and needs, you need to save between $7,200 and $14,400.

I would recommend looking into some high interest savings accounts, google it and do some research if you haven’t already. There’s a major benefit to these accounts compared to generic checking or savings accounts with your usual bank.

Step 5: invest

This is where it gets really fun. You are now to a point where you don’t need all of this additional money that you are saving. You can focus on your future self and let your money make you more money – Investing.

As a financial coach / blogger, this is the step where I can’t get into any specific funds but I can tell you about the overall strategy, and its a simple one: Invest in appreciating assets. These are things that you own that gain value over time. If you are down for an interesting read, check out ‘Rich Dad, Poor Dad‘ and ‘The Richest Man in Babylon‘. Both of these are quick reads, and very cheap for the knowledge you will get out of them!

Disclaimer, please reach out to a financial advisor for questions and do your own research before investing in the stock market.

Step 6: repeat and wait

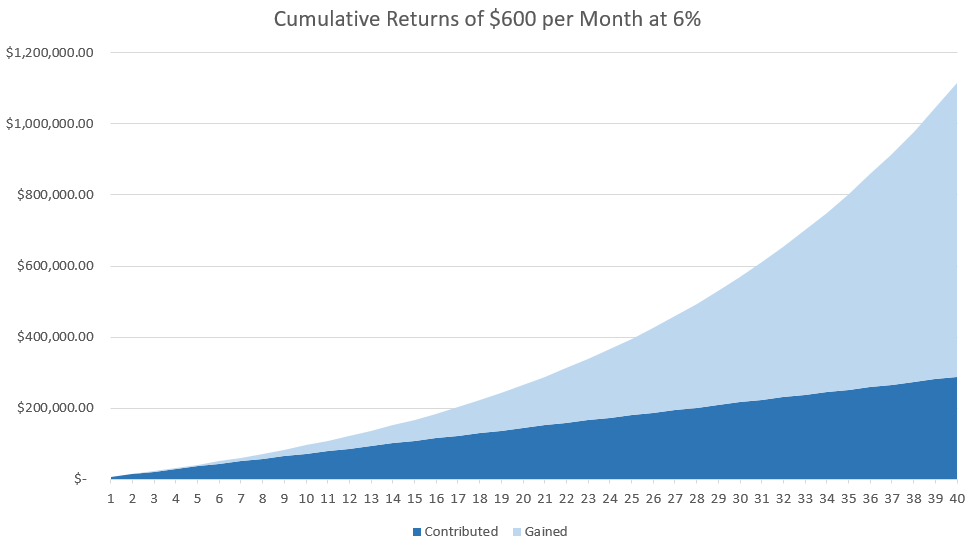

Now, you all you have to do is continue to invest in appreciating assets and have time work for you. The younger you are, the better time can serve you. Hypothetically, if you started today, investing $600 each and every month, and you are able to achieve a very modest return of 6% per year on average, you would have approximately $1 million dollars in 38 years.

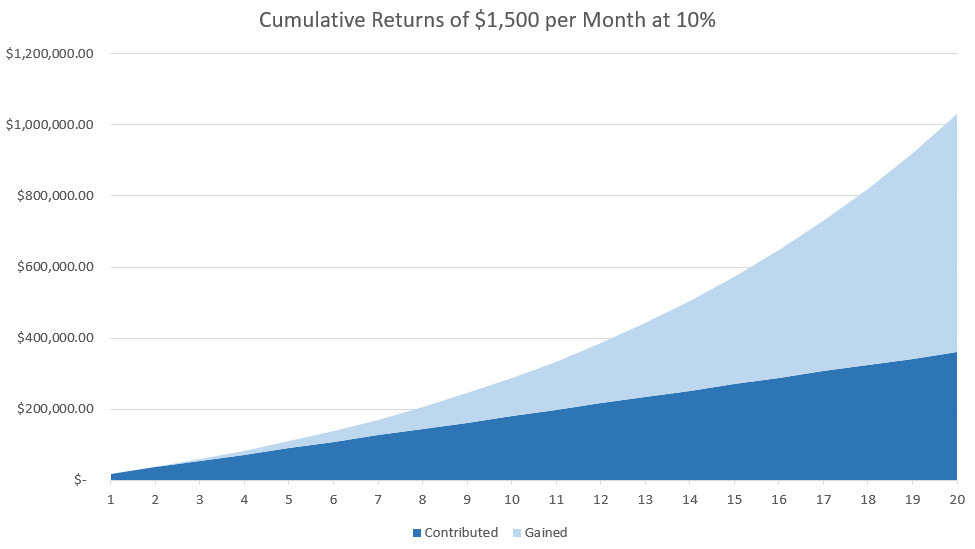

Say you can actually contribute $1,500 per month and you end up with historically great returns of 10% per year, you would be able to hit the $1,000,000 mark in 20 years.

And that is how you become a first generation, self made millionaire in only 6 steps.

Thanks for taking the time to read! The biggest compliment you can give is to recommend this post to someone who would benefit from it. As always, save more. Hit Your Money Mark.