How to: Building Your Savings

Everyone is in search of the quick and easy way to save money. You can read blog article after blog article that just take you in circles, saying:

“Save more than you spend.”

“Live below your means.”

“Increase your income with Uber or Doordash”

You may be telling yourself “But how do I actually do that? It’s not easy, and its not quick, and its not possible for me.“

There is a way to do it, and you are right, it won’t be quick and it wont be easy for most people. But it is very possible and I have seen it done by people who were in serious financial trouble. It all boils down to this: Have a plan.

Create a plan, create a plan that works for you, and create a plan that you can stick to. Beginning to save money is just like a diet, how many times have you watched a friend or family member start their diet by going all or nothing? They may have lost 5 lbs in the first 2 weeks, but usually, they fall off the wagon because they chose a diet that is unmanageable long term.

Beginning to save your money is the same thing as a healthy diet, but people are more sensitive towards talking about money that cutting calories so you never hear it. Your Facebook friends and those you follow on Instagram mention “I have been following this healthier lifestyle and working out regularly and after the first year, I am in the best shape of my life!”.

I can count on one hand the times I have seen a post that read “I created a plan for healthier spending and I was able to save $3,000 this year! I am now in the best financial shape I’ve ever been in!”

I wish it were more normalized to talk about money. To discuss struggles, opportunities, and not feel so unsettled by those conversations. But here we are. (By the way, if you ever feel like having a conversation about money, message me. I don’t like to follow those social norms and it’s one of my favorite topics to dive into with literally anyone.)

So back to the concept of having plan. There are so many different methods that each person can try, and one of them will work for you.

- Write down your money goals

- Determine how much you want to or can save each month

- Create a budget to save that specific amount each month

- Track your spending in a budgeting app like Mint, OR

- Track your spending by writing it down on a piece of paper if you aren’t a techy person

- Make the switch back to cash so you can see it leave your hands

- Pre-allocate your cash into envelopes – Food, fun, impulse purchases, once they run out, you’re done for the month.

- Reward yourself at savings intervals

- Look into free activities – backyard fires, cookouts, yard games, hikes, movie nights, etc. instead of expensive dinners, bar tabs, covers, etc.

- Talk to your friends and family about what they do to save

- Stay away from social creep, or do it the cheap way!

- But the most important, stick to your plan.

Whether you are saving $10 per month or $1,000 per month, the absolute most important thing is the ability to keep up with the plan. Make sure you build in budgets for things that bring you joy: sporting leagues, date night. But do your due diligence to stop the spending on those things that don’t bring you much joy (obviously, pay your bills everyone!)

Here are a few things that I have done just this month to improve my personal savings rate:

- Shopped around for insurance: $60 per month savings

- Paid off my cell phone, didn’t upgrade: $33 per month savings

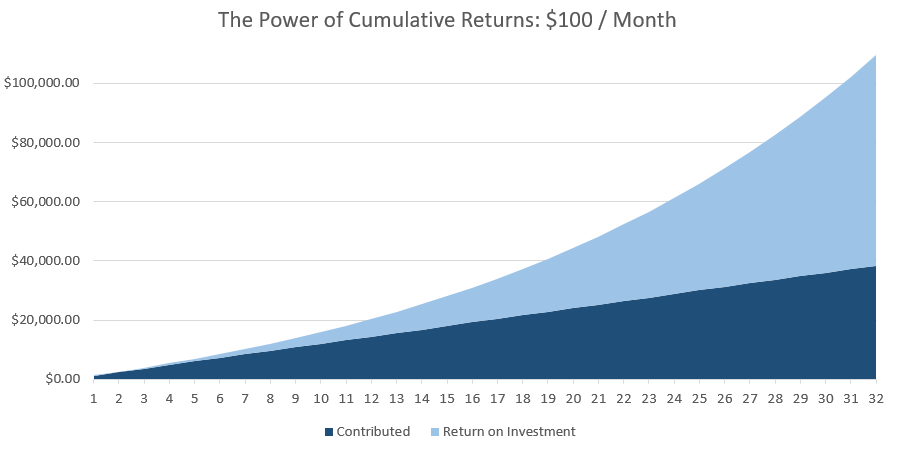

So those two items alone saved me almost $100 this month. Now $100 doesn’t seem like a lot, but over time, that $100 a month can equal $100,000. Check out the graph below which shows $100 per month invested at a growth rate of 6% for 32 years. I’ll go into significantly more details on the concept of investing and why cumulative returns is your best friend in my next blog article, but for now, we should continue to focus on savings.

My challenge to you is to create a plan that you can stick to and work towards saving 3x-6x your monthly expenses. For example, if you spend $2,000 per month on housing, transportation, food, loans, and entertainment, you should be shooting for a balance of $6,000 to $12,000 that you can stash away, untouched, for emergency purposes only!

This emergency fund will always be a little life support in case something crazy happens like losing your job during world wide pandemic that spikes unemployment rates to near 20%.

I do have to throw out a disclaimer that everyone is at different points in their financial journey and building emergency savings may not be the right best next step for your specific situation.

If you need some assistance in realizing your financial goals, understanding your best next step, creating a budget, or having someone to hold you accountable to a plan, I am here to help. Feel free to reach out to https://yourmoneymark.com/contact/ to get in touch!

Thank you for taking time to read my first blog. If you are interested in learning more about a specific topic, message me on Facebook https://www.facebook.com/yourmoneymark and I will gladly add to my list of blog articles to post in the future.

As always, Save More. Hit Your Money Mark.